The cryptocurrency market is growing by the day. The market grows in whole new markets with different uses such as world financial transactions like Bitcoin, Application platforms like Ethereum, Private financial transactions like Monero, WeTrust for the insurance industry and Specialty Currencies such as GameCredits and Lunyr. Cryptocurrencies are not created equally despite the fact that they are all based on the blockchain technology. These differences vary from the use of the software to the currency limitations. Despite this, the opportunities for asset growth are truly limitless.

Bitcoin can be considered as a digital gold nowadays, but also other cryptocurrencies such as Ethereum, Litecoin, Monero, DASH, WAVES and NEO are rapidly growing in value. A lot of large reputable organizations are really excited about the foreseeable future of the blockchain technology, that’s why big multinationals like Microsoft, BP, INTEL, IBM, MasterCard etc. are investing heavily in this technology. This caused an explosive growth in value of cryptocurrencies like Bitcoin (from $ 200 up to $ 4,300 in the summer of 2017) and Ethereum (from $ 6 up to $ 300 in 2017).

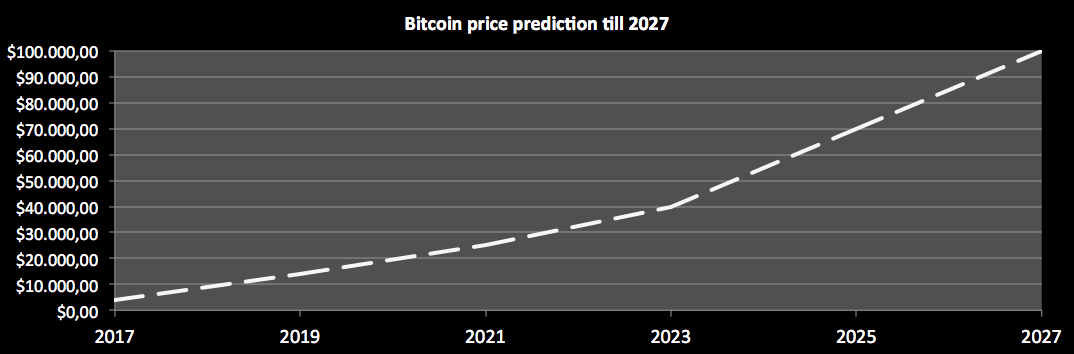

Some experts think that one Bitcoin can grow in the future up to $ 20,000 (read here); $ 100,000 (read here); $ 250,000 (read here) and even up to a half million dollars in value (read here) according to Business Insider. In other words, investing now can still be very profitable on the longer term as this market is growing day by day.

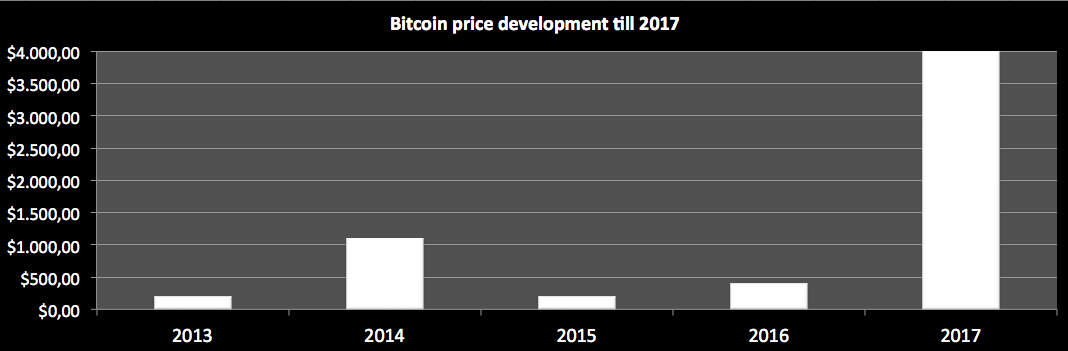

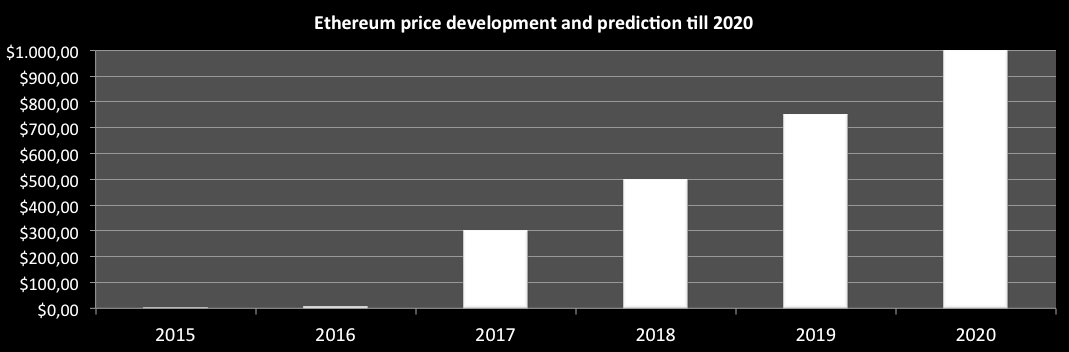

The below graphs where made in the summer of 2017

Ethereum managed it to grow from a value of $ 6,- in 2016 up to a value of $ 300,- in 2017 due to various cooperations with huge well-recognized organizations like Samsung, Toyota, IBM, Microsoft and ING.

Bitcoin was launched in 2009 but it wasn’t until 2013, after a series of updates and improvements funded partially by the Bitcoin foundation, when the currency became a topic of interest to the public. The value of Bitcoin has been on a steady increase and at the moment has gained around 400% in value. In 2012, venture capital firms were able to raise up to $2.2 million from Bitcoin. However, as of mid-2014, they raised $130 million in 57 million and 73 million investments placed on Bitcoin.

Up until 2013, Bitcoin prices were at $10 to $15. After a series of updates, Bitcoin began trading as high as $1163 the same year, 2013. The prices declined to stabilize at $200 before the market boom witnessed in 2016. When the global economy was led into a buying spree by China, Bitcoin was used as an alternative to people who were trying to escape the devaluation of the Chinese Yuan. To date, the largest volumes of Bitcoin transaction are made from China.

The market value of a Bitcoin stood at $4300.99 (at the time of writing, summer 2017) for one Bitcoin despite the price decline earlier in 2017. The SEC recently rejected a bid to launch a Bitcoin based ETF (Exchange Trade Fund). The news affected the prices of Bitcoin so much so that they fell to less than $1000. However, 4 months later after the SEC decision, a decision was made by SEC to review its earlier decision and thereby rallying Bitcoin price to an impressive 163% increase.

The world today is becoming more relevant to the internet. This is the reason why Bitcoin isincreasingly being applied as a medium of exchange for online purchases. What makes Bitcoin so valuable is the fact that the currency is scarce and useful. There are only 21 million Bitcoins in the world and as time goes by, it becomes harder to mine them. Bitcoin is digital gold. They provide predictable and sound monetary policy.

Its system of information transparency allows for Bitcoin miners to see when new Bitcoins are created and how many are in circulation. Bitcoin has always experienced an increase in value followed by a steady decline until its stable. Tools such as Bitcoin wisdom and Cryptowatch, provide charts that can help any willing investor to analyze and understand the price history of Bitcoin.

So what’s the future like for Bitcoin? Bitcoin’s has a number of advantageous features that will ensure it remains relevant as a currency. Bitcoin is the pioneer of cryptocurrency and given the fact that other cryptocurrencies only started to launch after 2011, Bitcoin does enjoy some first-mover privileges against them. The problem with this argument is that Bitcoin is used as a medium of exchange on various purchases, while Bitcoin is still in small quantities around the world.

However, if the price history of Bitcoin is anything to go by, there just is no stopping Bitcoin. The series of government interference from both the US and China have only had a temporary impact on Bitcoin prices and other cryptocurrencies. Evidence of this can be seen when big banking institutions such as Barclays, Credit Suisse, and HSBC holdings, have been reportedly taking an interest in cryptocurrencies, through a project by UBS Group AG, to create a new digital currency.